In the past, insurance customers were loyal, but today they are very fast moving. However, customer loyalty is an important issue for this sector of activity since, as in most sectors, retaining a customer costs much less than acquiring new ones. The best way to build customer loyalty is to make sure that the customers are satisfied with the services they have subscribed to, and in the insurance industry, the quality of the services will be tested especially when a claim is filed. This is the key moment in the customer relationship between the insurer and the policyholder. In this article, we would like to give you the keys to understand the challenges of customer loyalty in the insurance industry and show you how remote claims assessment can play a key role in your loyalty strategy.

The importance of customer retention in the insurance sector

Customer retention is a very important economic issue for the insurance industry, since acquiring new customers costs 7 to 9 times more than retaining existing ones. According to IBM, the cost of acquiring new customers in the insurance sector is constantly increasing. It is expected to increase from 15.8% of gross written premium (GWP) in 2018 to 17.9% in 2022. Insurance companies are actively investing in customer acquisition rather than trying to retain old customers, even though they are losing about 16% of customers each year.

Customer retention in the insurance industry is a complex issue for several reasons:

- It is a recent topic; until a few years ago, customers were very loyal

- Most consumers choose an insurance product out of convenience, not desire. This makes it difficult to implement a customer delight strategy

- Insurance is one of those services that you buy before you use it and would rather not have to use

Insurance customers have become very volatile. . The flexibility of the legislation concerning the conditions of resiliation (Hamon law, for example), the growth of the customers’ expectations and the increasingly strong competitive environment have strongly impacted their loyalty.

As you can see, given the high attrition rates, customer satisfaction has become an economic priority for the insurance industry. And one of the best ways to differentiate is to offer a customer experience that is perfectly aligned with consumers’ desires and expectations.

Claims management as a lever for customer retention

With 12 million claims recorded in France in 2020, the number of claims and the cost of compensation have been rising steadily for several years.

While preventing the risk of claims occurrence is a way to meet profitability challenges, their proper management is a lever for building policyholder loyalty.

The main mission of any insurer is to protect its policyholders from the risks of everyday life. The quality of an insurance contract will therefore be tested especially in the event of a claim and customer satisfaction at this key moment is a crucial issue in the relationship between the policyholder and the provider. Especially since, with one claim every four years, claims management is often the only point of contact between the insurance company and the policyholder. It is on this occasion that the client will be able to evaluate the capacity of the insurer to respond to the claim and to quickly cover all the damages and losses incurred.

It is also an opportunity for the insurer to build a relationship of trust with the clients, to offer them an exceptional customer experience and to ensure their loyalty.

Indeed, a satisfied customer will be more willing to renew the contract and to recommend the insurance. The opposite is truefor dissatisfied customers, who are almost certain to change their insurer.

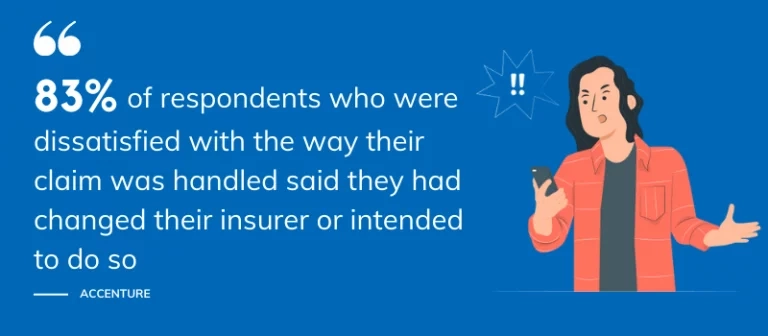

According to a survey of 8,000 home and auto insurance customers in 14 countries conducted by Accenture, 83% of respondents who were dissatisfied with the way their claim was handled said they had changed their insurer or intended to do so.

According to Accenture, among the factors that have a strong influence on policyholder loyalty after a claim, the time it takes to get claims handling and assistance, the time it takes to obtain compensation, and the quality of exchanges and transparency of information throughout the process are by far the most important, as they are cited as essential for 94% of policyholders around the world. The best way to increase customer satisfaction is therefore to handle the claim as quickly and professionally as possible.

How remote claims management can help build customer loyalty

Visual access to the loss has always been central to the claims management process. Typically, after a claim is reported to the insurance company, an adjuster visits the scene of the loss to collect visual evidence to assess the extent of the damage and estimate the loss to the client. Several working days may pass between the time the client submits the claim and the adjuster’s visit.

Remote appraisal, based on video-assistance, allows to revolutionize this process and to treat the claim more quickly. Thanks to video-assistance, the client can show the claim to an expert remotely. It avoids waiting for the adjuster to come and wasting time setting up an appointment with the client.

The video assessment is in itself a very simple and fast procedure. The video assessment is in itself a very simple and fast procedure. All the adjuster has to do is send an email or a text message with a link to establish a live video connection with the client (no application download is required), in order to see the damage and guide the insured through augmented collaboration tools.

In just a few minutes, the expert is able to make a quantified estimate of the damage as well as a proposal for compensation. At the end of the video assessment, the client can give an agreement to be quickly compensated by the insurance company.

In the case of small claims, the video assessment can even be carried out directly when the claim is reported to the insurer, a moment commonly known in insurance as FNOL (First Notice of Loss).

Time saved and a better customer experience that will increase customer satisfaction and have a positive impact on their loyalty.

Apizee’s video assistance solutions are the perfect answer to the uses of remote claims adjustment in insurance. We provide support and integration solutions to simplify customer interactions, provide an exceptional experience and ensure customer satisfaction in the claims process. Feel free to contact us to learn more or to get a demo.

Read also:

- Successfully implementing video loss adjusting services for claims management

- How to transform the customer experience in insurance thanks to remote loss adjustment

![[CX Industry Voices] Interview with Claire Boscq](/scripts/files/685be577407c05.79748508/claire-boscq.png)

![[CX Industry Voices] Interview with Simon Macklin](/scripts/files/6853c1e544e284.60938932/simon-macklin.png)