Video KYC in 2026: How It’s Evolving and 4 Steps to Implement It

Verifying a customer’s identity has always been a balancing act in financial services.

Before video Know Your Customer (KYC), traditional processes — involving branch visits, manual document checks, and days of waiting — protected institutions but frustrated customers.

It was a system designed for compliance, not convenience. But the world has moved on to keep up with increased digital onboarding, identity verification, and regulatory compliance.

According to a 2025 report, the global video KYC market is expected to reach the equivalent of €323.7M by 2026 and surge to €877M by 2033. Today, in digital-first banking and beyond, consumers expect speed and security in equal measure.

In this post, you’ll learn how to successfully implement video KYC to meet regulations, save time, and build customer trust.

Video KYC (Know Your Customer) is a digital process where banks, fintechs, or crypto exchanges verify a customer’s identity through a secure video interaction.

From opening a savings account to applying for a credit card or car loan, customers must prove who they are to prevent fraud.

Instead of traveling to a branch with a passport, driver’s license, or bill, institutions can confirm KYC documents and personal details checks over a remote video chat.

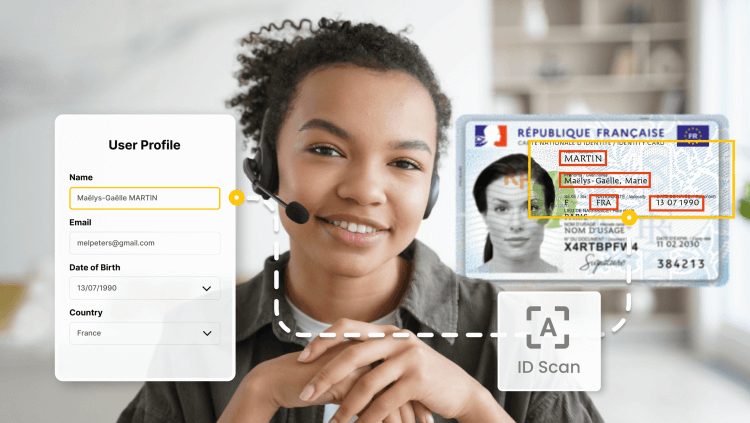

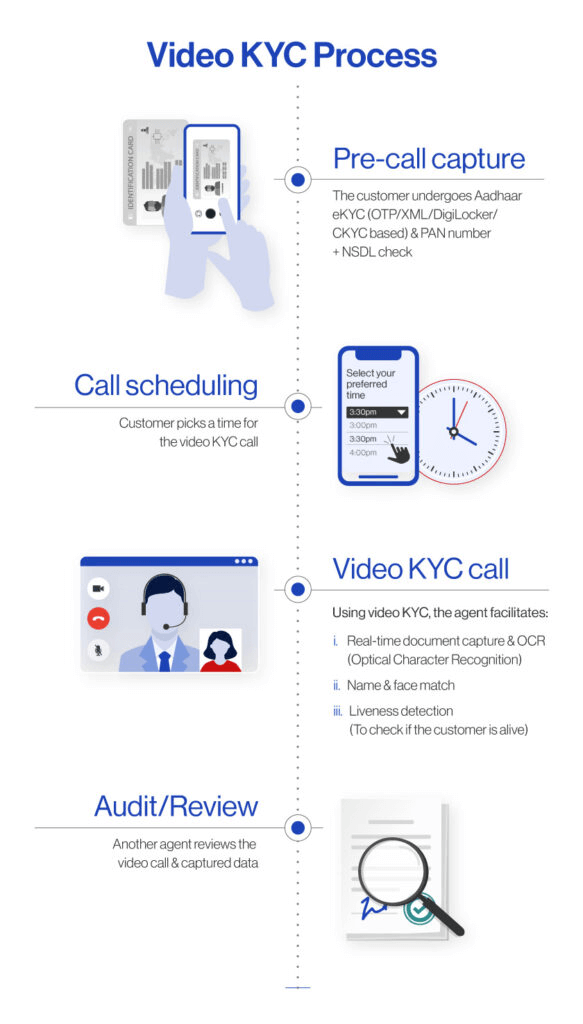

Here’s what that process looks like using software like Apizee:

Note: While video KYC is most typically found in financial services, its applications are rapidly expanding. Sectors like ecommerce, retail, and HR use it to verify identities for high-value transactions, account creation, or remote hiring. Video KYC also provides secure and efficient identity checks for airlines, casinos, and other regulated industries.

Even in a digital setting, video KYC works by supporting three compliance pillars:

While the video interaction makes onboarding fast and convenient, it still meets the same regulatory standards that govern traditional KYC processes.

There are four main types of KYC, each with slightly different definitions:

| Type of Know Your Customer (KYC) | What It Looks Like in Practice |

|---|---|

| Traditional KYC | Customers bring physical documents to a branch, wait in queues, and face up to days of manual checks before approval. |

| Electronic KYC (eKYC) | Customers upload documents online for automated KYC verification. It’s faster but lacks the security of a human review. |

| Video KYC (vKYC) | Customers log in from home, present ID and documents to a live agent (or record a verification video), and are approved in minutes. |

| Perpetual KYC (pKYC) | Instead of a one-time check, artificial intelligence (AI) and data feeds continuously monitor and refresh customer profiles to detect real-time risks. |

All forms of KYC aim to help financial institutions:

And the stakes are high for getting it right. According to the UN, around 2–5% of global GDP is laundered every year (equivalent to between €680 billion and €1.7 trillion).

While robust KYC is a legal requirement, it’s also your frontline defense against crime. And many financial institutions are learning how video can save time and money.

By adding live visual checks, video KYC helps financial institutions reduce manual effort and improve customer trust. All while maintaining a competitive edge in an increasingly digital banking landscape.

It transforms a slow and costly compliance process into a faster, secure, and customer-friendly experience.

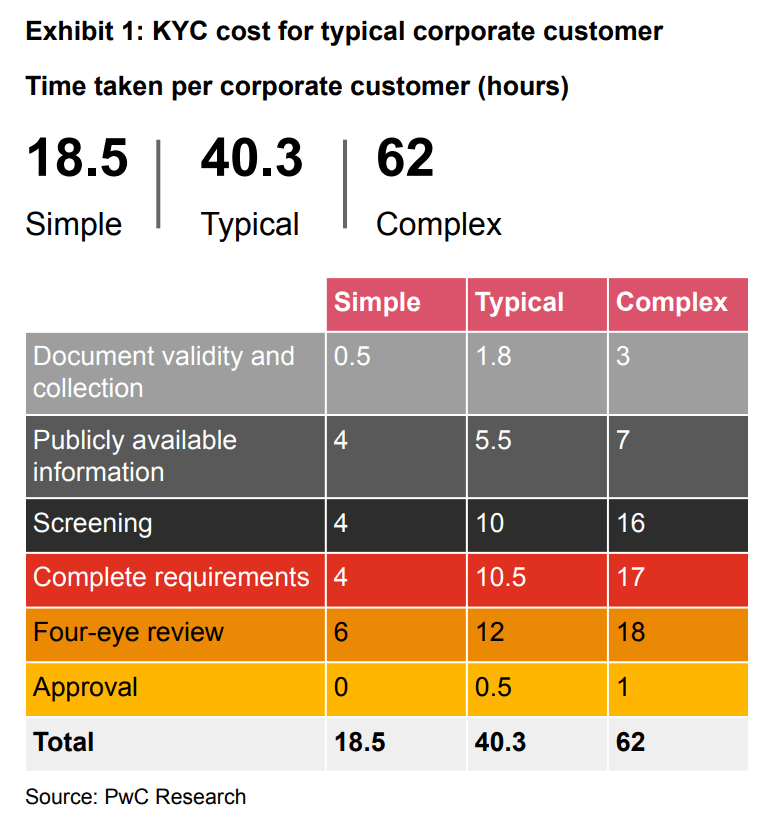

According to PwC research, KYC costs can make up around 3% of a bank’s total operational cost base. And complex corporate customers can even spend up to 62 hours on verification.

Many small and medium-sized businesses (SMBs) face even greater challenges, with limited budgets and compliance resources. In fact, 44% of UK financial institutions report that KYC regulations complicate operations.

And these regulations are tightening across Europe. Banks and fintech companies require more thorough checks, stricter due diligence, and ongoing monitoring.

Some notable examples include:

Serious violations in France carry penalties of up to €5 million or 10% of annual turnover. In Germany, administrative fines for transparency breaches can reach €150,000.

Banks can even face consequences when no money laundering occurs. For instance, the Bank of Lithuania fined Revolut €3.5 million because of gaps in monitoring customer activity and failing to detect suspicious transactions.

These growing regulatory pressures are forcing banks and fintechs to reassess their approach to compliance. Not only to avoid fines, but also to improve efficiency and the customer experience (CX).

Video KYC combines technology with a human touch to offer fast, secure, and convenient verification from anywhere.

Here are some of the main benefits of video KYC processes:

Example: Imagine a customer using Apizee to verify their ID over a remote video call. An agent confirms identity in real time, checks documents, and approves the account within minutes — all with just a stable internet connection.

In addition to banks, other industries like HR and ecommerce sites are increasingly using video KYC for more seamless onboarding processes and payments.

By verifying customers quickly and securely, video reduces checkout friction, prevents fraudulent purchases, and builds trust during high-value or first-time transactions.

All of these elements are key to a smoother online shopping experience.

Video verification and KYC procedures work best alongside technologies like:

| Video KYC Technology | What It Does |

|---|---|

| Computer vision | Detects anomalies in ID documents or images. |

| Facial recognition | Matches the customer’s face to the ID provided. |

| Biometrics | Uses fingerprints, voice, or facial patterns for verification. |

| Liveness detection | Ensures the customer is physically present and not using a photo, deepfake, or spoofing. |

| Optical character recognition (OCR) | Extracts text from IDs, passports, and documents for automated verification. |

| AI-powered risk scoring | Flags suspicious accounts based on historical and behavioral patterns. |

Visual AI also plays a crucial role in video KYC. Automated checks speed up identity verification, flag potential fraud instantly, and reduce human error.

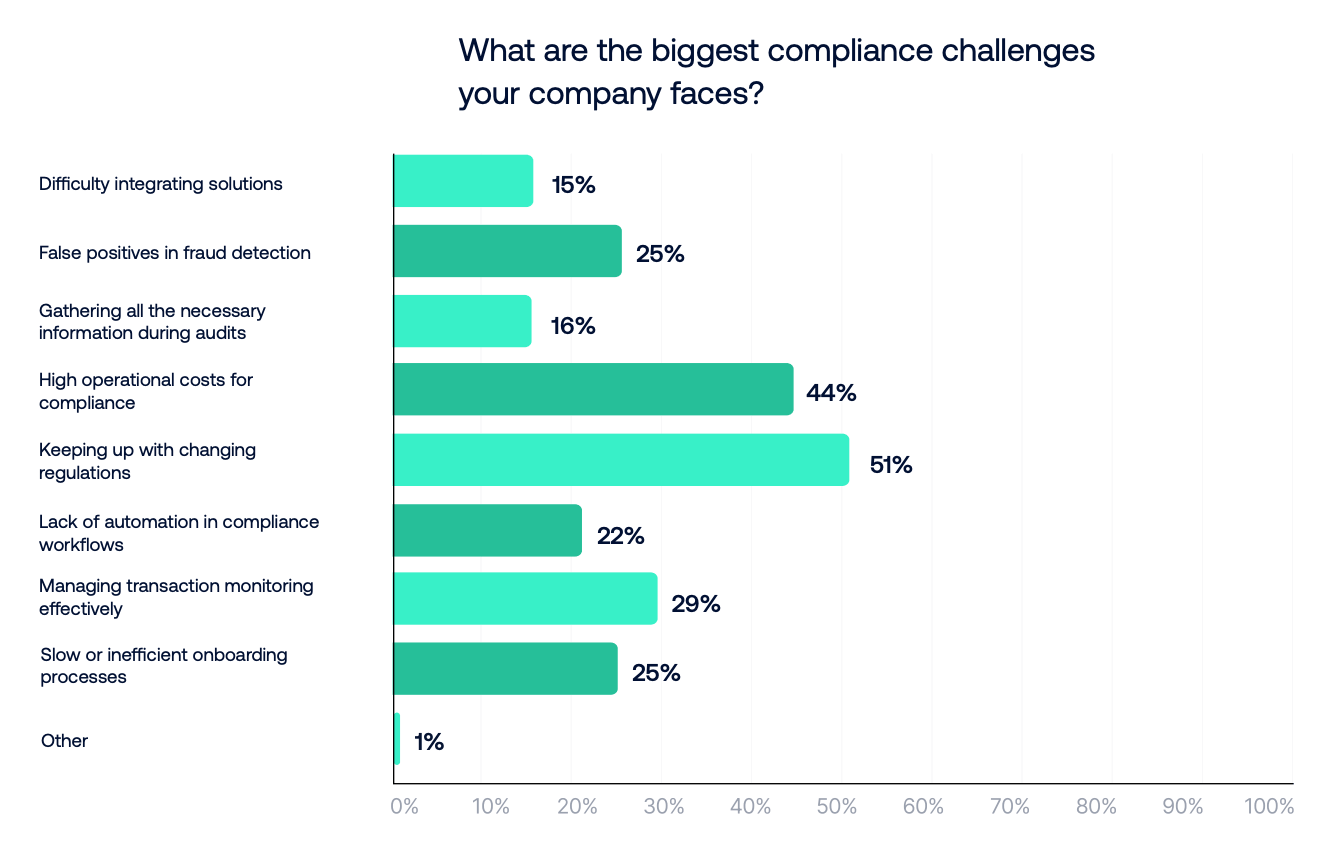

According to Sumsub research, 51% of fintech professionals cite “keeping up with changing regulations” as their biggest challenge.

When implemented carefully, AI helps institutions stay on the right side of the law while minimizing operational strain.

With the right mix of technology and strategy, KYC shifts from a regulatory checkbox to a competitive advantage.

Build confidence with customers while protecting your business from financial and reputational risk.

To successfully implement video KYC, financial institutions need a clear framework, clever software, trained staff, and automated processes that scale.

Follow these four steps to meet KYC requirements and keep your customers satisfied.

Defining your framework upfront ensures video KYC becomes a structured process that balances speed, security, and compliance from day one.

The framework acts as your “playbook” — defining what checks you require, when to escalate, and how to document each step.

Regulators expect you to assess every customer against the same standards. However, not every person carries the same risk. Treating all accounts the same eats up time and resources.

Proper planning makes it easier to onboard thousands of customers quickly without cutting corners.

Reminder: Your framework must cover three key areas we mentioned earlier (see below).

Let’s say a mid-sized European bank decides to roll out video KYC. It maps out these steps:

This layered approach ensures low-risk customers onboard quickly, while high-risk profiles receive the scrutiny regulators expect.

You can build your own video KYC framework by following some simple steps.

A well-structured strategy shields your institution from regulatory penalties while building trust and confidence with every customer interaction.

The right KYC tech stack protects sensitive data, automates fraud detection, and ensures your processes scale with customer demand.

Customer identity data is one of the most sensitive assets you’ll ever handle. Any weakness creates regulatory and reputational risk.

While banking is the most trusted sector for handling personal data, Thales research reveals that not a single industry reaches above 50% approval with customers.

To maintain people’s confidence and safeguard sensitive information, financial institutions must combine secure platforms with automation and human oversight.

Here are some of the best software solutions to consider:

| Video KYC Software | What It Offers |

|---|---|

| Thales OneWelcome Identity Platform’s IdCloud (biometrics) | Facial recognition, liveness detection, fingerprint, or voice recognition to confirm identity in real time. |

| Apizee (remote video platform) | Secure, encrypted video sessions that allow ID checks and customer interaction without requiring branch visits. |

| Entrust (document verification) | Automated capture and validation of passports, driver’s licenses, utility bills, and business records. |

| IBM (blockchain) | Tamper-proof audit trails and secure data sharing across institutions. |

Imagine a wealth management app onboarding a new customer using Apizee’s click-to-video functionality.

Customers click a web link, mobile app button, or QR code to start a video assistance session with the first available agent.

The meeting starts in a web browser (without downloading additional software), and the customer uploads their ID.

Alongside Apizee, Thales IdCloud liveness detection ensures that the person on camera matches the image, while AI-driven checks flag any real-time anomalies.

The documents get verified automatically through software like Entrust, while IBM’s blockchain logs create an auditable record for compliance.

The result? Fast, secure, and fully compliant verification without the customer ever leaving their home.

Even with the best tools in place, your teams need training to understand regulatory requirements and risk-based processes.

It also allows agents to provide clear guidance on the customer side, simplifying onboarding, reducing drop-offs, and creating a smoother first impression.

Even well-intentioned teams can struggle without structured guidance. In fact, TDCX research suggests that 49% of fintech companies cite KYC as their top challenge, with 37% of the most established brands experiencing the same issues.

Equipped agents are more confident in spotting problems early and effectively supporting customers.

Picture a payment platform rolling out video KYC where the compliance team already runs regular workshops.

When regulations change (e.g., new AML requirements), managers push micro-learning modules to staff and update customer FAQs in-app. This way, both sides stay aligned and compliant.

Here’s how to create practical training that supports both team members and buyers:

Regular, meaningful training bridges the gap between ever-changing regulations, internal workflows, and CX.

By keeping your team continuously updated and ensuring customers have clear instructions, you reduce compliance risk, lower error rates, and enhance trust in the onboarding journey.

Using automation and AI to scan documents, detect anomalies, and flag potential fraud reduces manual effort and speeds up verification processes. It also reduces errors while providing a seamless CX.

For example, AI can:

At the same time, human insight adds an extra layer of security when reviewing flagged cases and making judgment calls.

This combination is especially crucial as digital threats evolve. According to Sumsub, AI-generated deepfakes increased by 900% in Europe at the start of 2025, making automated liveness checks and anomaly detection critical.

Video KYC is also growing rapidly, especially in markets like India, where regulators encourage remote onboarding to enhance financial inclusion and speed up account openings.

For instance, the Reserve Bank of India (RBI) allows banks to automate verification using PAN cards (unique identifiers assigned to credit or debit cards), Aadhaar IDs (India’s national digital identity system), and other official documents.

RBI’s video-based customer identification process (V-CIP) verifies the document, matches the live face with ID, and flags any irregularities.

APIs (application programming interfaces) connect databases and verification tools directly into the video KYC platform, ensuring checks happen in real time.

End-to-end encryption also protects sensitive data and video streams from interception or tampering.

When paired with human support and robust identity sources (like PAN and Aadhaar), finance companies can meet regulatory requirements while keeping the process smooth and secure.

Understanding key risks of KYC and how to mitigate them protects your company and customers, preserves trust, and ensures you won’t break the law.

Here are five significant risks of KYC and how you’d solve them:

| KYC Risk | How to Mitigate It |

|---|---|

| Synthetic ID fraud | Use video KYC, cross-checking with AI-powered verification and multiple data sources. |

| Document forgery | Implement computer vision and facial recognition to detect anomalies. |

| Human error | Automate checks where possible and provide staff training. |

| Regulatory non-compliance and fines | Regularly update procedures, audit workflows, and use compliance software. |

| Customer frustration | Use eKYC and video KYC processes for fast, smooth onboarding (always backed up with human support). |

Adding video KYC to the process lets agents visually confirm identity and catch live issues that static uploads might miss. Without this safeguard, synthetic fraud or forged documents can pass undetected.

In fact, Sumsub also reports that synthetic identity fraud alone surged by 378% in Q1 of 2025 — demonstrating how quickly these threats evolve.

By understanding KYC risks and applying a mix of technology and human insight, financial institutions can safeguard compliance and keep customers happy.

For example, automation reduces errors and speeds up the onboarding process. Still, human judgment remains essential for reviewing unusual or flagged accounts.

Without this double layer, high-risk cases can slip through the cracks — leading to fraud, regulatory fines, or reputational damage.

Video KYC isn’t just about meeting regulations — it’s about protecting customers, preventing fraud, and making onboarding fast and seamless.

By combining automation with human oversight, your financial services companies will build trust while scaling safely.

Learn how Apizee’s secure video platform helps you create human links and deliver a frictionless customer experience.

Get a demoLearn how the C.A.L.M. method helps customer service teams stay composed, de-escalate tension, and resolve issues effectively.

How the C.A.L.M. Method Helps Customer Service Teams De-escalate Issues

27 Feb 2026

Discover how the LAER model helps customer service teams listen, acknowledge concerns, and resolve complaints with empathy and clarity.

How the LAER Model Helps Customer Service Teams Handle Complaints

20 Feb 2026

Everything You Need to Know About Digital Sovereignty

18 Feb 2026

Interested in our solutions?